Appropriation Highlights

Order and Organization

When writing appropriation highlights, it is important to list the appropriations according to the amount, with the largest listed first and the smallest listed last. Here is an example: HB 17 from New Mexico during the 2009 session. This is a group of three highlights from the summary:

-Appropriates $29 million from the Public School Capital Outlay Fund for the Public School Insurance Authority for reimbursing or paying property insurance premiums on behalf of school districts and charter schools (Sec. 7).

- Appropriates $4 million from the Tobacco Settlement Program Fund for the Human Services Department for the Medical Assistance Program (Sec. 5).

- Appropriates $3 million from the General Fund for emergency distributions to small rural school districts with a membership of 600 or less and resources totaling less than 5 percent or their operational budget (Sec. 6).

Notice that the above highlights are ranked according to the amount ranked from highest to lowest (29million - 4million - 3 million).

This rule also applies to indented highlights, which are used to explain allocations of appropriations. It is highly encouraged to detail at least part of the allocations of a large appropriation, although it is not required. In doing so, the sub-highlights also must be listed according to the amount, starting with the largest. Here is an example: HR 2346 from the U.S. Congress during the 2009 session. This one highlight from the summary:

-Appropriates $9.7 billion for the Department of State, U.S. Agency for International Development, and other agencies for costs associated with international assistance, including, but not limited to, the following (Title XI):

- $4.65 billion for bilateral economic assistance, including, but not limited to, $2.97 billion for the Economic Support Fund;

- $2.18 billion for international security assistance, including, but not limited to, $1.29 billion for the Foreign Military Financing Program;

- $1.94 billion for Diplomatic and Consular Programs; and

- $721 million for international peacekeeping activities.

Notice that the allocations in the sub-highlights are ranked from highest to lowest (4.65 billion -2.97 billion-2.18 billion-1.29 billion-1.94 billion-721 million).

Source(s) of Funding

Usually, it is important to the note the source(s) of the funding. This is primarily for state key votes in order to specify what portion of the appropriation consists of federal funding. You don't have to list ever single source that is specified in the appropriation, because some states have several funds that they draw from. However, you should note the major sources of funding, such as a "General Fund" and federal funds. When you encounter less significant sources of funding, you may specify each amount individually, or you may organize those into one category titled "other funds," or some variation thereof. Normally, you won't list the source(s) of funding for allocations of appropriations. And, when listing the sources of funding, they too should be listed according to the amount, with the largest listed first and the smallest listed last. Here is an example: HB 1300 from South Dakota during the 2009 session.

-Appropriates $872.44 million for the Department of Social Services, of which $614.44 million are federal funds, $247.96 million are general funds, and $10.03 million are other funds. This appropriation is allocated as follows (Sec. 7):

- $661.91 million for medical and adult services;

- $94.21 million for children's services;

- $90.14 million for economic assistance; and

- $26.18 million for Secretary of Social Services Administration.

- Appropriates $675.25 million for the Department of Education, of which $406.32 million are general funds, $264.92 million are federal funds, and $4.01 million are other funds. This appropriation includes, but is not limited to, the following allocations (Sec. 11):

- $345.75 million for state aid to general education;

- $233.66 million for education resources;

- $46.8 million for state aid to special education;

- $19.77 million for postsecondary vocational education;

- $9.71 million for the Secretary of Education Administration;

- $9.29 million for technology in schools; and

- $6.31 million for career and technical education.

First, notice that the above highlights list the major sources of funding (federal funds and general funds) and organizes the rest into the "other funds" category. Second, notice that the sources of funding are ranked from highest to lowest, hence why the first source listed on the first highlight is federal funds and the first source on the second highlight is general funds. Finally, notice that the allocations in the sub-highlights only list the purpose of the funding (ex: "adult services" and "general education"), and NOT the source of funding. Those too are ranked from highest to lowest.

Budget Bills

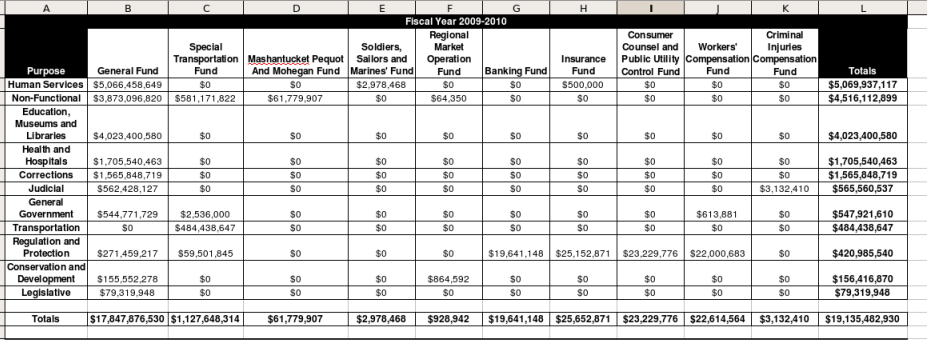

When you're dealing with a budget or budget-related bill, appropriations typically represent the bulk of your summary. In some cases, appropriations consume the entirety of your summary. Therefore, it helps to organize the appropriations before writing the summary. The easiest way to do this is using a spreadsheet. Sometimes this is necessary to get the totals for total appropriations for departments or specific purposes (if the bill does not specify totals). Other times, it is simply helpful for properly organizing the highlights on your summary. There is no one correct way to create a spreadsheet for a budget or budget-related bill, because the format of a budget varies by state. Sometimes you have to be creative in how you organize the appropriations on your spreadsheet. Here is an example: HB 6802 from Connecticut during the 2009 session. This was the budget for two fiscal years: 2009-2010 and 2010-2011. This is the spreadsheet that was created for fiscal year 2009-2010:

First, notice that the appropriations are all organized under the headline "Fiscal Year 2009-2010," whereas another portion of the spreadsheet would be dedicated to fiscal year 2010-2011. Second, notice that the individual columns are dedicate to the sources of funding. Third, notice that the individual rows are dedicated to the purpose of the funding, and this is especially helpful because the bill did not provide the totals for these categories. Finally, notice that there is a column and row dedicated to totals for each category, whether it is a source of funding or a purpose of the funding. The cell on the bottom right ($19,135,482,930) is the grand total for that fiscal year.

This is the highlight on the summary for HB 6802 for the 2009-2010 fiscal year:

-Appropriates $19.14 billion to respective departments and agencies for fiscal year 2009-2010, of which $17.85 billion is from the General Fund, $1.13 billion is from the Special Transportation Fund, and $159.96 million is from other funds, to be allocated as follows (Secs. 1-10):

- $5.07 billion for Human Services, including, but not limited to, the following allocations:

- $3.84 billion for Medicaid;

- $244.02 million for State Administered General Assistance;

- $120.82 million for Personal Services;

- $117.43 million for Temporary Assistance to Families (TANF);

- $103.87 million for Child Care Services (TANF/CCDBG); and

- $105.94 million for the Department of Mental Health and Addiction Services (disproportionate share);

- $4.52 billion for Non-Functional Spending, including, but not limited to, the following allocations:

- $2.11 billion for Debt Service;

- $2.1 billion for Employee Fringe Benefits; and

- $188.95 million for payments to local governments for loss of taxes on state property and private tax-exempt property;

- $4.02 billion for Education, Museums and Libraries, including, but not limited to, the following allocations:

- $2.68 billion for the Department of Education;

- $561.95 million for the Teachers' Retirement Board;

- $235.29 million for the University of Connecticut (not including the appropriation for the University of Connecticut Health Center);

- $163.11 million for Connecticut State University;

- $159.85 million for Regional Community-Technical Colleges; and

- $118.97 million for the University of Connecticut Health Center;

- $1.71 billion for Health and Hospitals, including, but not limited to, the following allocations:

- $1 billion for the Department of Developmental Services; and

- $608.99 million for the Department of Mental Health and Addiction Services;

- $1.57 billion for Corrections to be allocated as follows:

- $869.27 million for the Department of Children and Families; and

- $694.14 million for the Department of Correction;

- $565.56 million for Judicial Spending, including, but not limited to, $499.63 million for the Judicial Department;

- $547.92 million for General Government Spending, including, but not limited to, $141.63 million for the Office of Policy and Management;

- $484.44 million for the Department of Transportation;

- $420.99 million for Regulation and Protection, including, but not limited to, $169.83 million for the Department of Public Safety;

- $156.42 million for Conservation and Development; and

- $79.32 million for Legislative Spending.

Notice that each sub-highlight is listed from highest to lowest, beginning with $5.07 billion for Human Services and ending with $79.32 million for Legislative Spending. These totals are specified in the spreadsheet. Also notice that some of the sub-highlights contain allocations that are not contained in the spreadsheet. These are figures that would not be listed on the spreadsheet, but instead be retrieved from the bill itself.

When dealing with allocations of appropriations on a budget or budget-related bill, it is usually best to settle on a minimum amount to be included in your summary. Meaning, any allocation below the minimum threshold that you have decided upon will probably not be included in the summary. Notice on the highlight for HB 6802 listed above that none of the allocations are lower than $105.94 million (the allocation for the Department of Mental Health and Addiction Services from the $5.07 billion appropriation for Human Services). Of course, you wouldn't pick a random, obscure figure like $105.94 million. Rather, the minimum figure that was selected was $100 million, and that happen to be the lowest allocation above that figure. Also, notice that the appropriation for Legislative spending was included, despite it being below $100 million. This is because this was a full appropriation for a specific purpose that was included on the spreadsheet.

The selection of a minimum amount for allocations is a judgment call on your part. After reviewing the bill, select a minimum amount that will allow for decent amount of allocations to be included on the summary, but also one that won't result in an excessively lengthy summary. Also, remember to utilize the phrase "...including, but not limited to, the following..." so that people understand that there are additional allocations being listed. Here is an example: HB 3 from New Mexico during the 2009 session. This is what is considered a "budget-related bill," because it isn't a full budget, but it does amend an existing one and makes various fund transfers. Here is one highlight from the summary that details the fund transfers:

-Transfers $114.84 million from various funds and other revenue sources to the General Fund, including, but not limited to, the following transfers (Sec. 1):

- $68 million from the College Affordability Endowment Fund;

- $5 million from the cash balances of the Department of Higher Education's Special Program Fund;

- $3.5 million from the Workers' Compensation Administration Fund;

- $3 million from the Enhanced 911 Fund;

- $2.85 million from the Higher Education Performance Fund;

- $2.5 million from the Hazardous Waste Emergency Fund;

- $1.9 million from the Instructional Material Fund;

- $1.7 million from revenue generated by the Driver Safety Fee;

- $1.5 million from the Real Estate Commission Fund;

- $1.5 million from the Electronic Voting System Revolving Fund;

- $1.5 million from the Community Corrections Grant Program;

- $1.5 million from the Community Corrections Department Intensive Supervision Fund;

- $1.45 million from the Public Pre-Kindergarten Fund;

- $1.2 million from the revenue generated from the antitrust case and consumer protection settlements;

- $1.18 million from the Juvenile Community Corrections Grant Fund;

- $1.1 million from the Property Valuation Fund;

- $1 million from the New Mexico Medical Board Fund;

- $1 million from the Crime Laboratory Fund;

- $1 million from the Uninsured Employers' Fund; and

- $1 million from legislative cash balances.

Notice that the phrase "...including, but not limited to, the following..." is utilized to introduce the highlight. Of the specific allocations, there are several $1 million allocations listed at the bottom, and nothing below that. Therefore, $1 million is the minimum amount selected for allocations. This allowed for there to be a fair number of allocations listed, but if you were to include every other fund transfer bellow $1 million, the highlight would be excessively long.

Of course, there are exceptions to the rule of establishing a minimum amount for allocations. For example, if the press focused specifically on an allocation that is less than the minimum amount that you settled on, you should include it. However, because budgets and budget-related bills are all-inclusive, it is important that we not focus exclusively on a few appropriations and allocations mentioned in the press - other aspects of the bill should be included in the summary as well.